Ethereum’s blockchain ecosystem continues to grow at an impressive pace, with treasuries across its network now topping a whopping $22 billion. The Ethereum Foundation (EF), a non-profit organization that supports the development and sustainability of Ethereum, has been instrumental in managing and allocating funds to ensure the long-term success of the ecosystem. In its latest annual report, released in late October 2024, the EF highlighted its treasury holdings, recent financial updates, and new policy initiatives aimed at enhancing transparency and fostering integrity.

As the Ethereum network faces new challenges and opportunities in the rapidly evolving world of blockchain, the Foundation’s substantial treasury reserves and its commitment to supporting ecosystem growth have positioned Ethereum for continued success. This post will dive into Ethereum Foundation’s treasury strategy, ecosystem funding initiatives, and the new policies designed to ensure the network’s growth is both sustainable and transparent.

Ethereum’s treasuries now exceed $22 billion—an incredible resource to fuel the blockchain’s future growth and innovation.

Ethereum Foundation’s Treasury: A Financial Backbone for Growth

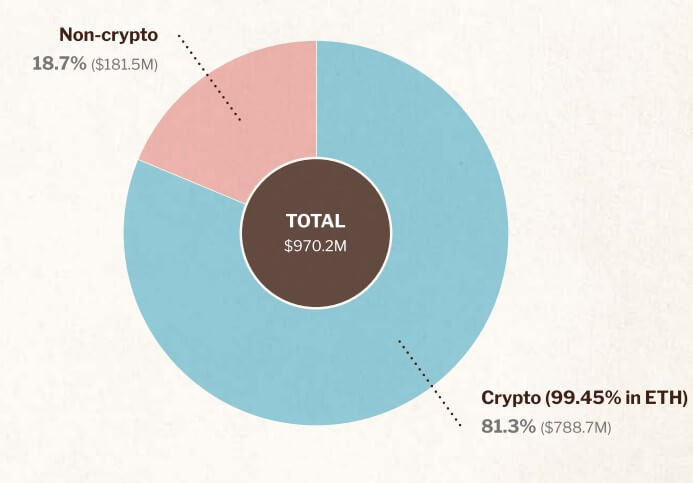

The Ethereum Foundation’s treasury is a critical resource for Ethereum’s continued development and expansion. As of October 31, 2024, the EF’s treasury stood at an impressive $970.2 million, with $788.7 million in crypto assets (primarily ETH) and $181.5 million in non-crypto investments. The foundation’s ETH holdings represent a small but significant portion of Ethereum’s total supply, about 0.26%, indicating both confidence in the network and a long-term commitment to maintaining Ethereum’s position in the global blockchain ecosystem.

The EF views its treasury as a financial safety net, enabling it to fund important projects and initiatives within the Ethereum ecosystem. These projects can range from development tools and educational resources to partnerships that drive innovation within decentralized applications (dApps). By periodically converting a portion of its ETH holdings into fiat currency, especially during market upswings, the EF ensures that it has ample resources to weather any downturns in the cryptocurrency market.

In a rapidly changing space like blockchain, having a diversified treasury gives the Ethereum Foundation the flexibility to invest in various projects while still holding a significant portion of its funds in ETH, showing unwavering confidence in the long-term potential of Ethereum.

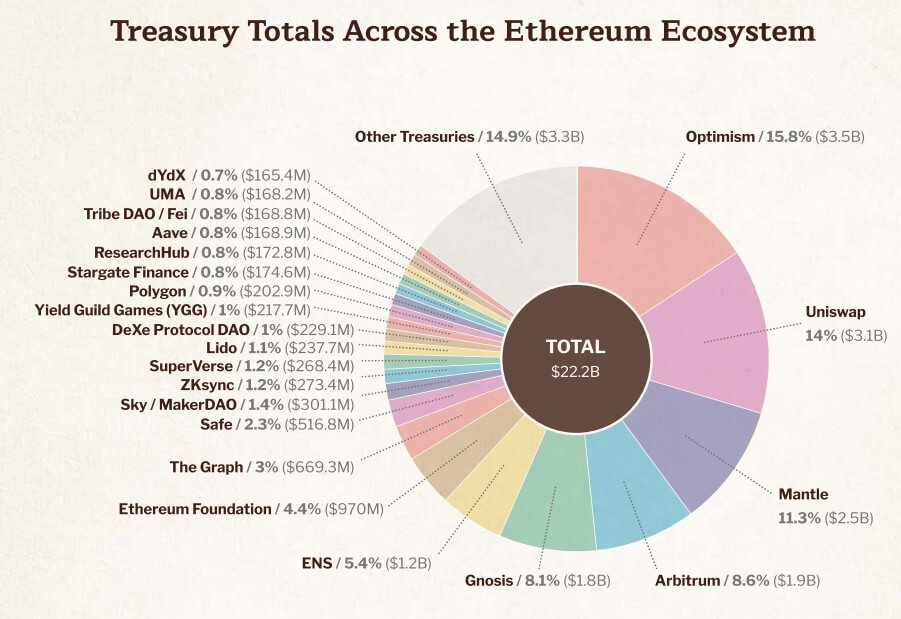

Ethereum Ecosystem Treasuries: A $22 Billion Powerhouse

Beyond the Ethereum Foundation’s own treasury, Ethereum’s broader ecosystem is supported by a massive collective of $22 billion in combined treasury assets. This includes holdings from various decentralized autonomous organizations (DAOs), protocols, and foundations that contribute to the growth and health of the Ethereum ecosystem. The assets are primarily made up of native tokens from successful crypto projects such as dYdX, Aave, Polygon, The Graph, Uniswap, Arbitrum, Lido, and many others.

The Ethereum ecosystem’s collective treasury represents an incredible amount of resources that can fuel continued innovation and expansion in the blockchain space. Even small allocations from these funds can significantly bolster development efforts, including everything from protocol upgrades to grants for new projects. This vast pool of assets offers a unique advantage over other blockchain networks that may not have such deep financial backing.

With a strong financial foundation across the ecosystem, Ethereum is well-positioned to remain a leader in decentralized finance (DeFi), NFTs, and smart contract-based applications. These treasuries not only fuel the growth of the projects within Ethereum’s ecosystem but also create a more resilient network overall by ensuring resources are available for research, development, and scaling initiatives.

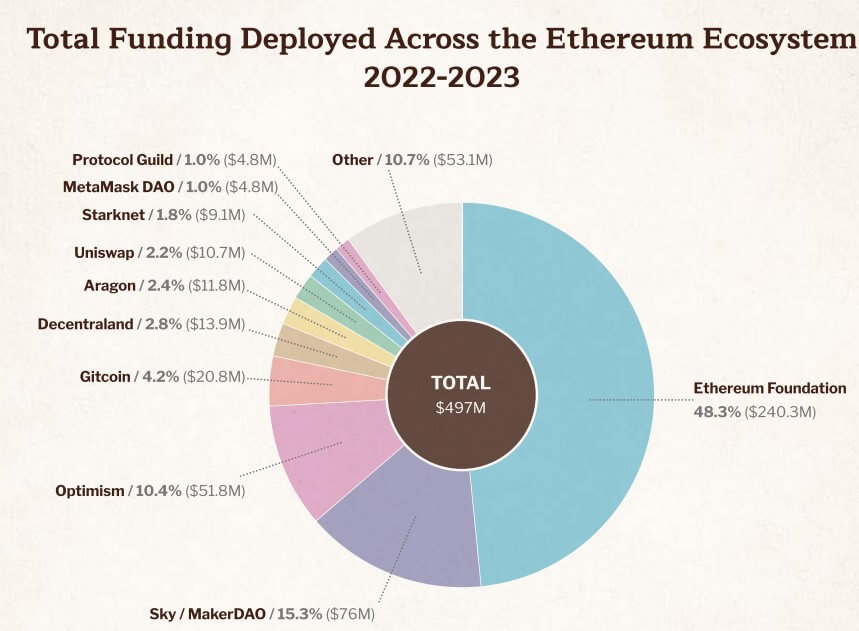

Ecosystem Funding: A Collaborative Effort to Drive Innovation

One of the key themes in the Ethereum Foundation’s 2024 annual report is collaboration. The EF and its ecosystem partners have allocated nearly $500 million to Ethereum-related projects over the last two years. In 2022 and 2023 alone, the EF contributed $240.3 million, accounting for nearly half of the total funding, while the remaining funds came from a variety of ecosystem partners such as MakerDAO (rebranded as Sky), Optimism, Gitcoin, Aragon, Uniswap, and others.

These funding efforts reflect Ethereum’s decentralized nature, with a variety of organizations and communities working together to support the network’s long-term growth. Aya Miyaguchi, the EF’s director, emphasized that this collaborative funding approach mirrors Ethereum’s research and development processes. Just as Ethereum’s technical development encourages collaboration among decentralized teams, its financial contributions to ecosystem projects help to ensure that innovation is always moving forward.

This shared funding model is crucial for maintaining the vibrancy and resilience of the Ethereum ecosystem. By providing capital for developers and entrepreneurs building on Ethereum, the ecosystem ensures that the blockchain remains the go-to platform for decentralized applications. Whether it’s supporting new governance models, decentralized finance platforms, or emerging technologies, these investments are key to Ethereum’s continued success.

A New Conflict of Interest Policy for Enhanced Transparency

As Ethereum continues to grow, maintaining transparency and integrity within its ecosystem becomes increasingly important. In response to recent controversies surrounding its advisory roles, the Ethereum Foundation has introduced a new conflict of interest policy designed to ensure that all investments and financial decisions made by the EF are free from personal or organizational biases.

Under the new policy, any investments exceeding $500,000 (excluding ETH) must be disclosed, and any EF members with significant exposure to related assets will be excluded from decision-making processes. This policy aims to reduce the risk of conflicts of interest while fostering trust within the Ethereum community.

By implementing this policy, the Ethereum Foundation is taking proactive steps to demonstrate its commitment to transparency and to avoid any potential pitfalls that could arise from perceived or actual conflicts of interest. This move not only strengthens the EF’s internal governance but also enhances the trust of the broader Ethereum community. As Miyaguchi stated, this policy reflects the Foundation’s ongoing efforts to uphold the highest standards of integrity within the Ethereum ecosystem.

Final Thoughts: A Strong Foundation for Ethereum’s Future

Ethereum has come a long way since its inception, and the latest updates from the Ethereum Foundation signal a bright future for the blockchain network. With $22 billion in ecosystem treasuries, a diversified treasury holding of nearly $1 billion, and a clear focus on sustainable, collaborative funding, Ethereum is in a position to continue leading the charge in blockchain innovation.

The Ethereum Foundation’s commitment to transparency and integrity through its new conflict of interest policy further strengthens its standing as a trusted pillar in the blockchain space. These financial and policy initiatives ensure that the network remains robust, transparent, and well-equipped to handle the challenges of tomorrow.

As Ethereum continues to evolve and adapt, its ecosystem will undoubtedly benefit from these strategic efforts, driving long-term growth and providing more opportunities for developers, entrepreneurs, and decentralized projects to thrive. The future of Ethereum is bright, and with the right financial and governance structures in place, the blockchain network is poised to continue its leadership in decentralized technologies.

It is particularly prescient considering Ethereum Foundation researchers recently came under fire for taking advisory roles with restaking protocol EigenLayer.